The Ghana Water Company Limited (GWCL) has proposed a 280% increase in water tariffs, citing the devastating effects of illegal mining (galamsey) and water body pollution as the main drivers.

The proposal, submitted during the Public Utilities Regulatory Commission (PURC) stakeholder engagement for 2025, represents the highest tariff adjustment request among utility providers, following a similar submission by the Electricity Company of Ghana (ECG).

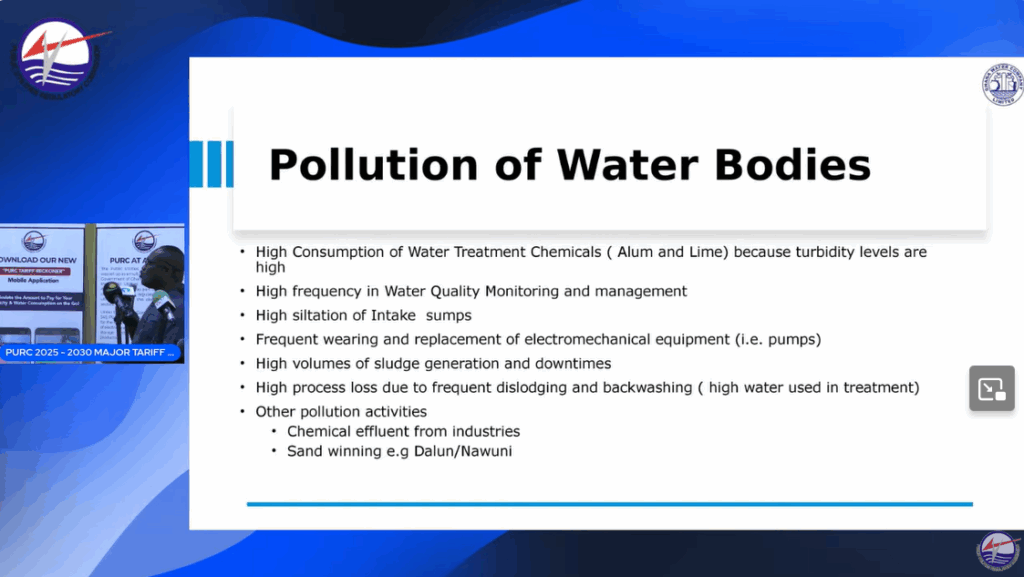

GWCL explained that rampant river and stream pollution has sharply increased operational costs, requiring unusually high volumes of treatment chemicals such as alum and lime due to rising turbidity. Frequent siltation of intake sumps and high sludge generation are also causing equipment damage and downtime.

ECG’s Chief Manager of Corporate Planning, Michael Klutse, noted that industrial chemical effluents and sand winning activities in areas like Dalun and Nawuni continue to worsen the situation.

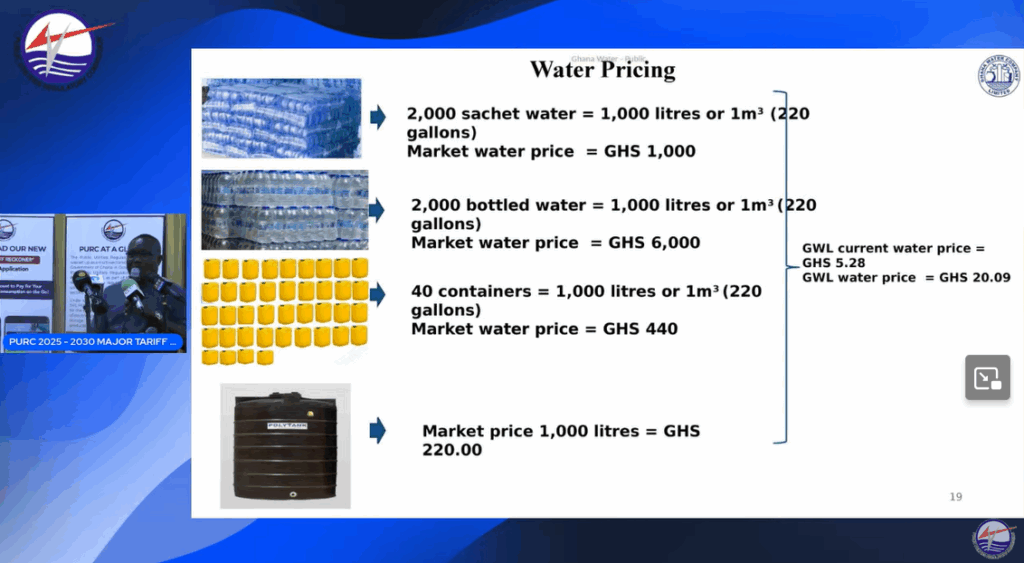

In a comparative analysis, GWCL highlighted that the market price of water far exceeds the current utility tariff.

A thousand litres of sachet water costs around GHS 1,000, bottled water the same quantity sells for about GHS 6,000, and containerized water costs roughly GHS 440, compared with GWCL’s current tariff of just GHS 5.28 per 1,000 litres.

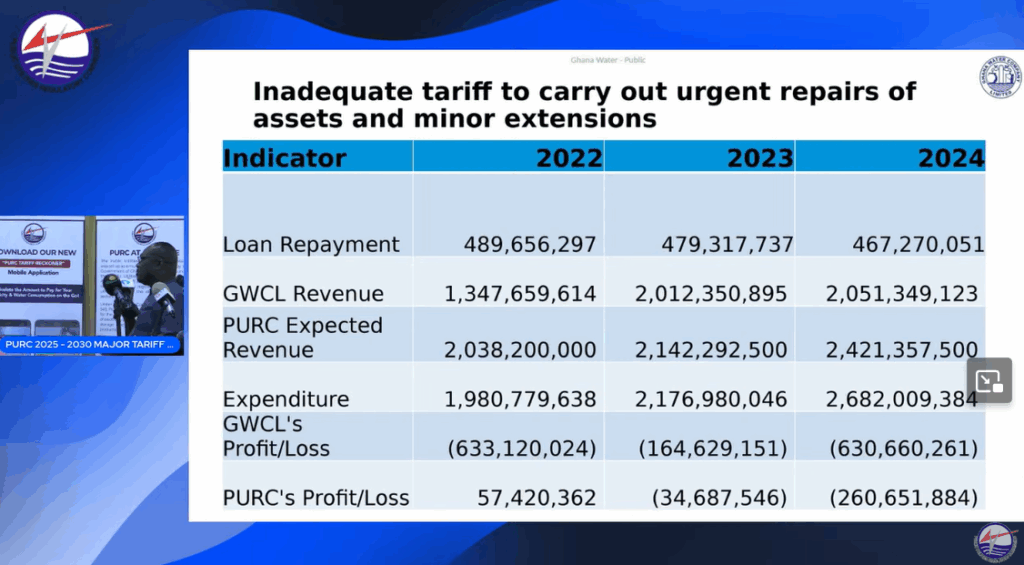

The company argues that the proposed adjustment is necessary to sustain operations, maintain water quality, and replace worn-out electromechanical equipment.

The PURC is expected to review GWCL’s submission alongside other proposals before announcing approved tariffs for the 2025–2030 period.

Meanwhile, ECG has submitted a proposal to PURC for a 225% increase in its Distribution Service Charge (DSC1), citing the need to prevent financial collapse and ensure reliable power supply. The proposed new charge would raise DSC1 from GHp19.0384/kWh to GHp61.8028/kWh for 2025–2029.

Serving over 73% of Ghana’s population and 4.87 million customers, ECG argues that its current tariff is unsustainable.

The DSC1 currently constitutes only 11% of the total electricity value chain cost, far below the global benchmark of 30–33%. Combined with the Ghana cedi’s 74% depreciation between 2022 and 2024, the real value of ECG’s revenue has fallen by 45%.

To address these challenges and respond to public complaints about service quality, ECG has outlined plans to invest the additional revenue in critical infrastructure.

Source: Myjoyonline

ALSO READ: