When debt levels fall, they credit that to currency appreciation, and when debt levels rise, they also blame it on appreciation. They were bragging that the stronger Cedi helped to reduce the debt stock, so why this contradiction?

How does currency appreciation cause debt to go up? Indirectly, yes, I can understand through capital flows, etc., but not directly. Still struggling to understand.

You came to meet a foreign currency-denominated debt level that had been assessed with the exchange rate at 14.3 to the dollar at the end of 2024.

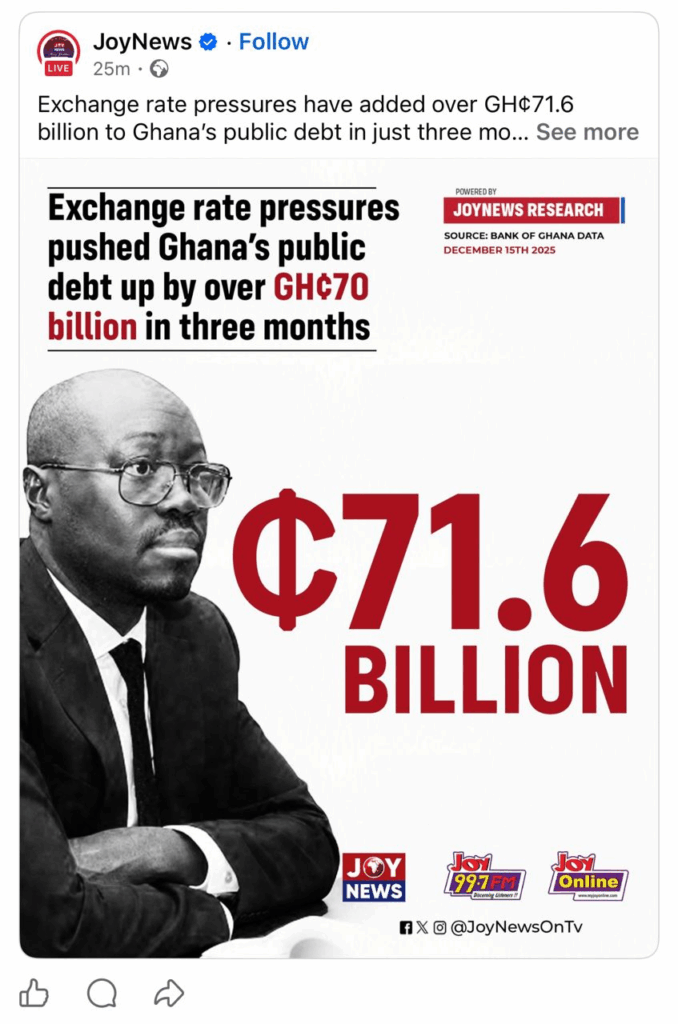

Now the exchange rate is around 11.4 to the dollar, and the debt stock has gone up, and you attribute that to exchange rate pressures. The depreciation of the currency in the last three months alone (from about 10.4 to about 11.4, on average) cannot explain the high stock increase in debt of over GH₵71 billion.

This clearly shows a complete lack of understanding of the debt dynamics. The Minister for Finance should please come again.