The Ghana Revenue Authority (GRA) has rejected claims that the new Value Added Tax (VAT) system will drive up prices or create unfair competition, particularly for spare parts dealers.

In a statement issued on Tuesday, February 10, 2026, the Authority responded to concerns raised by the Abossey Okai Spare Parts Traders Association, which argued that the VAT regime introduced under the Value Added Tax Act, 2025 (Act 1151) places an extra burden on traders and could result in higher consumer prices.

The GRA explained that these concerns stem from a misunderstanding of how the revised VAT framework operates.

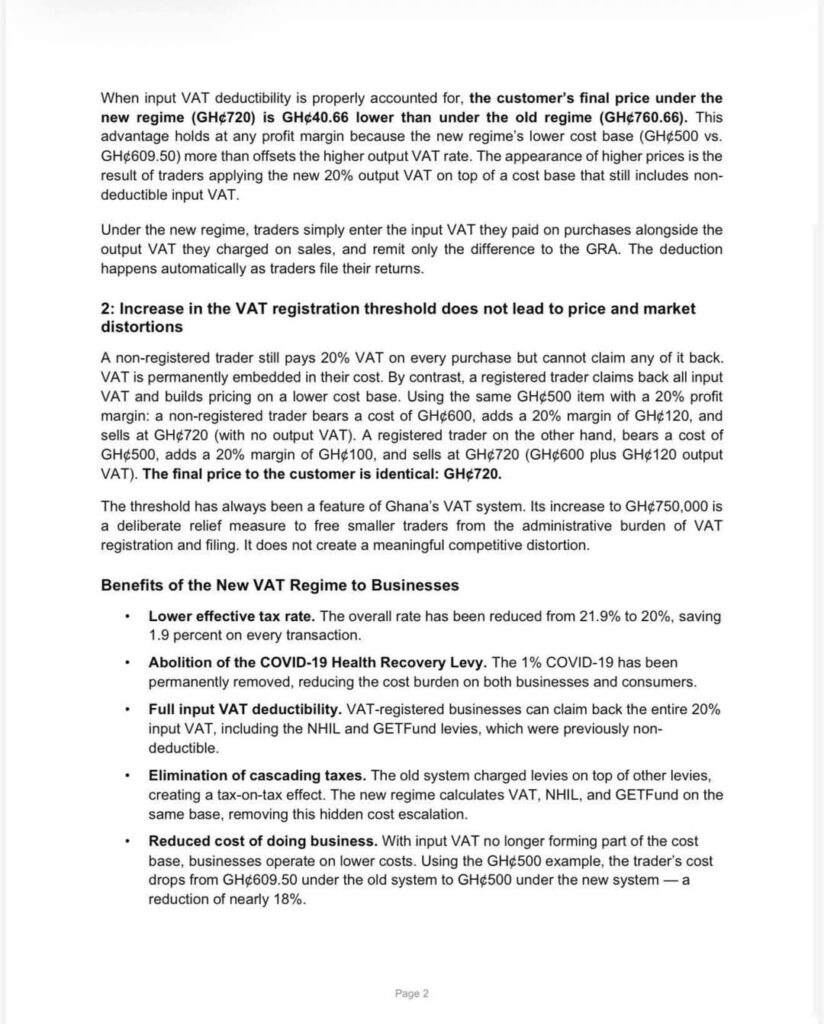

Under the former 4 percent flat-rate scheme, traders paid 21.9 percent input VAT on purchases, which could not be deducted and was therefore built into costs. Under the new arrangement, the standard VAT rate is 20 percent, and input VAT is fully deductible, reducing the actual cost base for businesses.

To illustrate the impact, the Authority used an example of a product costing GH¢500 with a 20 percent profit margin. Under the old system, the final consumer price would be GH¢760.66, while under the new regime, the same product should sell for GH¢720.

“The appearance of higher prices is the result of traders applying the new 20 percent output VAT on top of a cost base that still includes non-deductible input VAT,” the statement explained.

The GRA noted that under the new system, businesses declare both input and output VAT in the same return and pay only the difference, rather than passing embedded taxes to consumers.

The Authority also dismissed claims that increasing the VAT registration threshold to GH¢750,000 would distort competition. It explained that unregistered traders still pay 20 percent VAT on purchases but cannot claim deductions, while registered traders can recover input VAT and price goods from a lower cost base. Using the same GH¢500 example, both registered and non-registered traders would ultimately sell at GH¢720, with the higher threshold intended to ease compliance for small businesses, not advantage larger ones.

The GRA further highlighted that the new VAT system lowers the effective tax rate from 21.9 percent to 20 percent, removes the 1 percent COVID-19 Health Recovery Levy, allows full deduction of input VAT including NHIL and GETFund levies, eliminates cascading “tax-on-tax” effects, and simplifies VAT administration, thereby reducing the cost of doing business.

According to the Authority, a trader’s cost on a GH¢500 item drops from GH¢609.50 under the old system to GH¢500 under the new one, representing a reduction of nearly 18 percent.

The GRA maintained that recent price increases in the market are not caused by the policy itself but by errors during the transition period. “The price increases currently being observed are the result of a failure to remove now-deductible input VAT from cost calculations,” the Authority stated.

To assist businesses in adjusting, the GRA has set up a joint technical team with the Ghana Union of Traders’ Associations (GUTA) to guide traders on record-keeping, input tax claims, and correct pricing. The Authority added that it is ready to extend similar support to Abossey Okai traders and other affected groups.

ALSO READ: