Payments remain one of the biggest obstacles to Africa’s ambition of building a truly integrated single market under the African Continental Free Trade Area (AfCFTA), Second Deputy Governor of the Bank of Ghana (BoG), Matilda Asante Asiedu, has said.

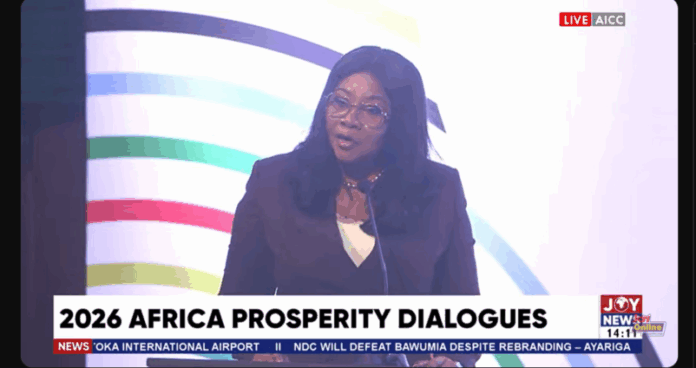

Speaking at the Africa Prosperity Dialogues 2026, she stressed that without secure, affordable, and reliable payment systems, efforts to deepen intra-African trade would fall short.

“Payments make trade possible. Without secure, affordable, and reliable means of transferring value, the promise of a truly integrated African market cannot be achieved,” she said.

According to Madam Asiedu, payment systems should be seen as strategic trade infrastructure, critical for monetary stability, financial integration, and long-term economic transformation across the continent.

Despite Africa’s enormous economic potential, she noted that cross-border payments within the continent remain expensive, slow, and fragmented.

“Transaction costs for intra-Africa payments exceed between 7 and 10 per cent, compared to about 3 per cent globally. Settlement times can also take days or even weeks,” she explained.

She said these challenges, while significant, also present major opportunities for innovation and reform.

The deputy governor highlighted that AfCFTA brings together a market of more than 1.5 billion people with a combined gross domestic product (GDP) of about $2.8 trillion. If fully implemented, she said, trade within Africa could double in the medium term.

However, she cautioned that such growth would only materialise if the continent’s payment systems are upgraded to match its trade ambitions.

Madam Asiedu also pointed to Africa’s leadership in digital finance, particularly in mobile money and financial inclusion.

“With more than half of the world’s mobile wallets on the continent, Africa has shown that technology can expand financial inclusion and transform livelihoods,” she said, citing Ghana as a leading example.

She added that while digital finance has made it easier for people to transact within their countries, more must be done to enable seamless payments across borders.

“Inclusion must not stop at national boundaries. It must extend beyond individual countries if Africa’s single market is to truly work,” she noted.

The Africa Prosperity Dialogues 2026, held in Accra, brought together policymakers, business leaders, financial institutions, and development partners to discuss practical ways of accelerating economic integration and trade under AfCFTA.

Ghana, which hosts the AfCFTA Secretariat, continues to play a central role in driving conversations around trade facilitation, digital payments, and regional integration.

Industry players at the forum agreed that improving payment infrastructure, harmonising regulations, and promoting interoperable digital platforms will be critical to unlocking the full benefits of intra-African trade.

ALSO READ: