The Ministry of Finance has announced the development of a 10-year insurance master plan aimed at strengthening the insurance sector.

The master plan, which is expected to be completed by the of 2026 will include reforms to address challenges such as pricing, low penetration rates, which has been a bane in the industry for decades and other structural issues that continue to limit the growth and impact of the insurance industry.

“The insurance master plan will serve as a blueprint for policy, regulation, and institutional reforms aimed at addressing structural challenges, such as low penetration, fragmented regulatory frameworks, pricing inefficiencies, and other market constraints,” he noted.

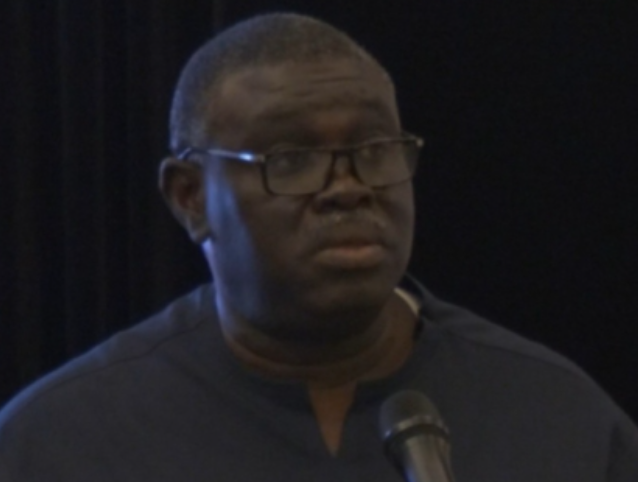

Speaking at the 12th investiture of the Ghana Insurers’ Association, a Coordinating Director at the Ministry of Finance, David Klottey Collison, said the initiative is intended to position Ghana as an insurance hub in the sub-region.

“The Ministry of Finance, in collaboration with industry stakeholders, will develop a 10-year insurance master plan this year to promote innovation and competitiveness, and position Ghana as a regional insurance hub”, he added.

Mr Collison added that the overarching objective of the plan is to expand financial inclusion, promote innovation and competitiveness, and strengthen Ghana’s standing in the sub-regional insurance market.

Beyond the master plan, the Ministry of Finance has also taken note of proposals from industry players to deepen insurance coverage nationwide.

“We have also taken note of the Ghana Insurance Association’s call for group life insurance to be made compulsory,” he said.

The proposed reforms are expected to spark renewed policy discussions around insurance accessibility, affordability, and the role of regulation in building a resilient and competitive insurance sector.

The Ministry also revealed that it shall begin the strict enforcement of insurance for local commercial cargo from the 1st of February this year.

According to the ministry, the law, which mandates that all imports into Ghana must be insured locally, under section 22 of the Insurance Act, 2021 (Act 1061), will protect small and medium businesses from potential risks associated with carriage of goods.

READ ALSO: